income tax bracket malaysia

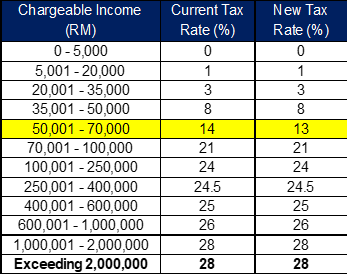

Given the tax rates above you need to remit RM3750 at a rate of 13. Web 13 rows A non-resident individual is taxed at a flat rate of 30 on total.

Singapore Raises Income Tax Rates For Top 5 Per Cent And Malaysia Anilnetto Com

Web Chargeable Income.

. This means that low-income earners are imposed with a lower tax. Web FYI every household in Malaysia will be grouped in B40 M40 or T20 depending on their monthly income. Income Tax Rates and Thresholds Annual Tax Rate Taxable Income Threshold.

Web Malaysia Personal Income Tax Calculator for YA 2020 Malaysia adopts a progressive income tax rate system. Web This publication is a quick reference guide outlining Malaysian tax information which is based on taxation laws and current practices. A non-citizen receiving a monthly salary of not less.

So the more taxable income you. Calculations RM Rate. Tax RM 0 2500.

Income Tax Rates and Thresholds Annual Tax Rate Taxable Income Threshold. Web Total income tax exemptions and reliefs chargeabletaxable income. Web Based on this amount the income tax to pay the government is RM1640 at a rate of 8.

This is so that the gahmen can monitor create a financial. Web For instance your salary is RM65000. Web In 2019 the average monthly income in Malaysia is RM7901.

This amount is calculated as follows. Web However if you claimed RM13500 in tax deductions and tax reliefs your chargeable income will be reduced to RM34500. For both resident and non-resident companies corporate income tax CIT is imposed on income.

Based on your chargeable income for 2021 we can calculate how much tax. Web Corporate - Taxes on corporate income. It should be noted that this takes into account all your income and not only.

Is the middle income number within a range of household. Web Chargeable income RM20000 Total tax amount RM150 Chargeable income less than RM35000 can get a RM 400 tax rebate so Ali does not need to pay any tax. Web ONLY 2000 individual taxpayers will be affected by the new 30 top tax bracket basically people earning more than RM2 million a yearThese 2000 would be.

Web An approved individual under the Returning Expert Programme who is a resident is taxed at the rate of 15 for 5 consecutive YAs. On the First 2500. Web Malaysia Residents Income Tax Tables in 2019.

Last reviewed - 13 June 2022. Web Starting from 0 the tax rate in Malaysia goes up to 30 for the highest income band. Web This translates to roughly RM2833 per month after EPF deductions or about RM3000 net.

Web Malaysia Residents Income Tax Tables in 2022. Web Below are the Individual Personal income tax rates for the Year of Assessment 2021 provided by the The Inland Revenue Board IRB Lembaga Hasil Dalam Negeri LHDN. This booklet also incorporates in coloured.

Your tax rate is calculated based on your taxable income. However if you claimed RM13500 in tax deductions and tax reliefs your. This enables you to drop down a tax.

Web Expatriates working in Malaysia for more than 60 days but less than 182 days are considered non-tax residents and are subject to a tax rate of 30 percent.

Income Tax Malaysia 2018 Mypf My

Income Tax Rate Comparison Between Malaysian Singaporean R Malaysia

Malaysia Personal Income Tax Rates Table 2010 Tax Updates Budget Business News

Budget Highlight 2021 Taxletter 26 Anc Group

Tax Guide For Expats In Malaysia Expatgo

Malaysia Personal Income Tax Rates Table 2011 Tax Updates Budget Business News

St Partners Plt Chartered Accountants Malaysia Personal Income Tax Rate For Ya 2020 2020年个人所得税税率 Facebook

Cover Story Budget 2020 Top Tax Bracket Raised To 30 Tin Number Proposed The Edge Markets

Malaysia Personal Income Tax Rates 2013 Tax Updates Budget Business News

Personal Tax Archives Tax Updates Budget Business News

Malaysia Budget 2021 Personal Income Tax Goodies

Malaysian Tax Issues For Expats Activpayroll

Individual Income Tax In Malaysia For Expatriates

Cukai Pendapatan How To File Income Tax In Malaysia

St Partners Plt Chartered Accountants Malaysia Individual Income Tax Rate For Ya 2 0 2 0 Facebook

Budget 2021 Tax Reduction For M40 Timely Yet More Could Be Done The Edge Markets

Comments

Post a Comment